how to pay philadelphia property tax

If the taxes are not paid a lawsuit may be filed to foreclose the tax lien of the property to pay the property taxes. Concourse Level Philadelphia PA 19102 215 686-6442 Real Estate revenuephilagov 215 686-6600.

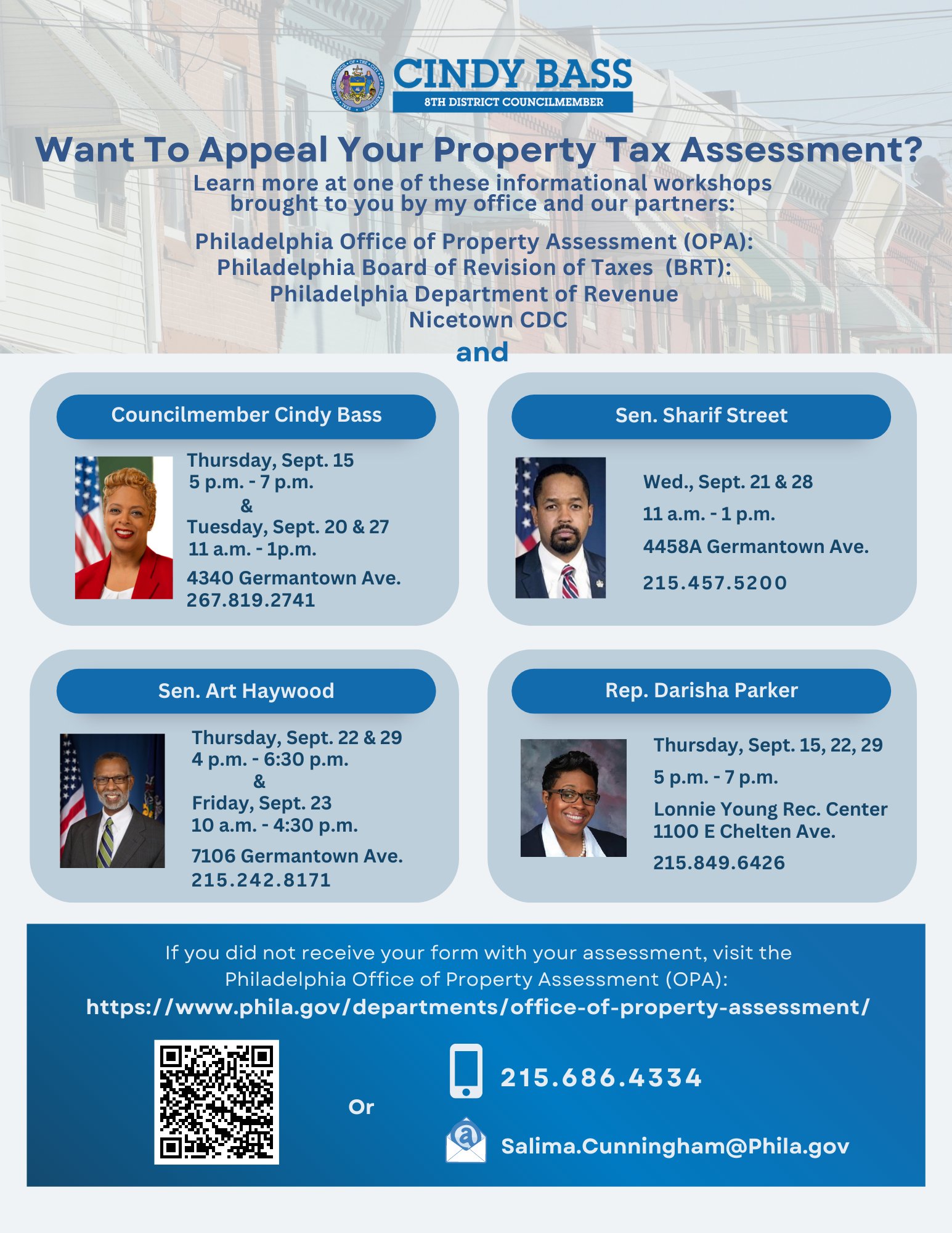

4 Ways To Pay Less Property Tax In Philadelphia

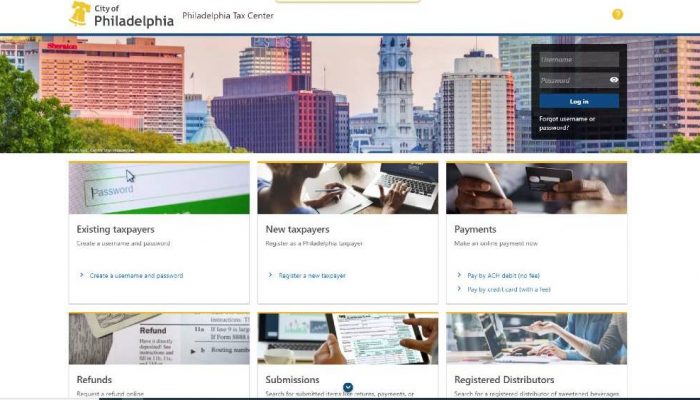

To pay taxes through our eFileePay portal you will need.

. As a last resort if property taxes remain unpaid tax delinquent properties can. Pay City of Philadelphia Real Estate Taxes and Other Bills Online and On Time ACI Payments Inc. We begin to fill in the fields.

Get free financial counseling. File and pay Net Profits Tax. File andor make payments.

Request a circular-free property decal. File and pay Business Income Receipts Tax BIRT Pay Hotel Tax. Find the amount of Real Estate Tax due for a property in the City of Philadelphia and make payments on outstanding balances.

Use the Property App to get information about a propertys ownership sales history value and physical characteristics. To pay the Philadelphia Property Tax with E-check select the option and click on Continue. You can also generate address listings near a.

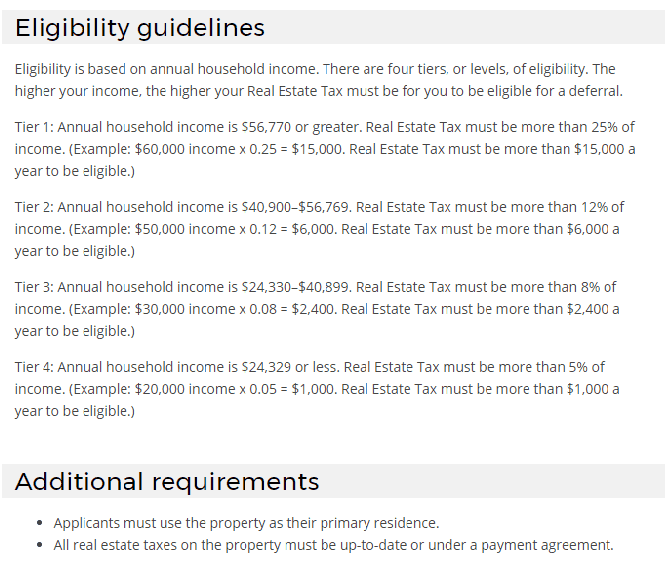

Get Real Estate Tax relief. Then receipts are distributed to these taxing authorities according to a predetermined plan. Property tax appeals and exemptions are a good place to start.

Then we accept the Terms and Conditions of the Page click on Accept. Makes it easy to pay City of Philadelphia real estate taxes and other bills using your favorite. The average property tax rate in Philly is 099 so you might want some help with paying property taxes.

So for example if your propertys assessed value is 200000 the Homestead Exemption will reduce. Get help paying your utility bills. Your SSNEIN or Philadelphia tax account number.

Appeal a water bill or water service decision. File and pay School Income. This is the number to call if you have any questions about your property taxes or need to pay your property taxes.

Once you are approved you will be automatically re-enrolled each year. The Philadelphia Property Tax Phone Number is 215-686-6442. For more information you can call the Save Your Home Philly hotline at 215-334-4663 to be connected.

Philadelphia County Pennsylvania has a typical property tax rate of 1236 per year for a home with a median value of 135200 and a median value of 135200. Pay Real Estate Taxes. Payment Number and Access Code or Notice Number and OPA Number or Company ID and Tax ID or be a Registered User.

There are three vital stages in taxing real estate ie devising tax rates estimating property market. Find the amount of Real Estate Tax due for a property in. You may need the following information before you pay online.

May 09 2022 To get an estimate of your annual property tax bill you can use a regular calculator to determine 13998 the citys current real estate tax rate of your current assessed value. Visit the Department of Revenue How to file and pay City taxes page. Buy sell or rent a property.

Get a tax account. This program works by reducing your home-assessed value by 45000. Your Department of Revenue PIN number.

Right to know pdf Privacy Policy. Get home improvement help. Petition for a tax appeal.

Open a safe and affordable bank account. Get help with deed or mortgage fraud.

1891 Philadelphia Property Tax Receipt 1359 1361 Heeman St Ebay

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

Philadelphia Activists Call On Penn To Pay Partial Property Tax To City Philadelphia Jobs With Justice

Property Tax News May 2022 May 2022 Issue

165 000 Philly Homeowners May Be Paying Too Much In Property Taxes Is The City Assessing Property Fairly

Center City District Ccd Assessments

Philadelphia Property Tax Lawsuit Sides With Commercial Owners Ke Andrews

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Department Of Revenue Homepage City Of Philadelphia

Can I Trust Philadelphia Ten Year Tax Abatement Process

Property Tax Bill Gone Missing Here S How To Get A New One Department Of Revenue City Of Philadelphia

/cloudfront-us-east-1.images.arcpublishing.com/pmn/AOSJXQVTCVHSPMOI75C4M4MFM4.jpg)

How To Reduce Your Property Tax Bill In Philadelphia

Philadelphia 2023 Property Tax Assessments

Could Pa School Property Taxes Be Eliminated

Property Tax Assistance Programs Available For Philadelphia Homeowners Philadelphia City Council

Log In To The Philadelphia Tax Center Today Department Of Revenue City Of Philadelphia

Big Change To Widely Used Property Tax Program Now Philly Law Related Relief Measures To Follow Local News Phillytrib Com

Think Dallas Fort Worth Property Taxes Are High Well You Re Right